In Australia, the laws and regulations that surround each type of business structure can be complicated - so what do you need to know to make the right choice?

Opening a new business isn’t as easy as throwing the doors open and making millions in your first week of trading. Whether we like it or not, there are many necessary evils to tackle when it comes to doing business in Australia, and one of the key decisions to make in the early days is settling on what form of business structure you plan on trading under.

Your choice of structure will depend on the size and type of business and how you want to run it. Each structure may have an impact on key areas such as tax you’re liable to pay, asset protection and costs to set up. While choosing a business structure is a common process for new enterprises, it’s also not unusual for brands to tweak their structure type when they are looking to expand or change direction.

While there is no right or wrong business structure to opt for, it’s important to weigh up the below factors to determine which is the most appropriate and beneficial for your new or existing brand.

Your personal liability exposure from your business products or services

Whether you have (or plan to have) partners or investors in the business

The administrative costs of setting up and maintaining your business structure

The tax effectiveness of the structure

Once you’ve carefully considered your priorities, needs and requirements, what are your options when it comes to selecting a business structure to operate in Australia?

The Four Common Types Of Business Structures

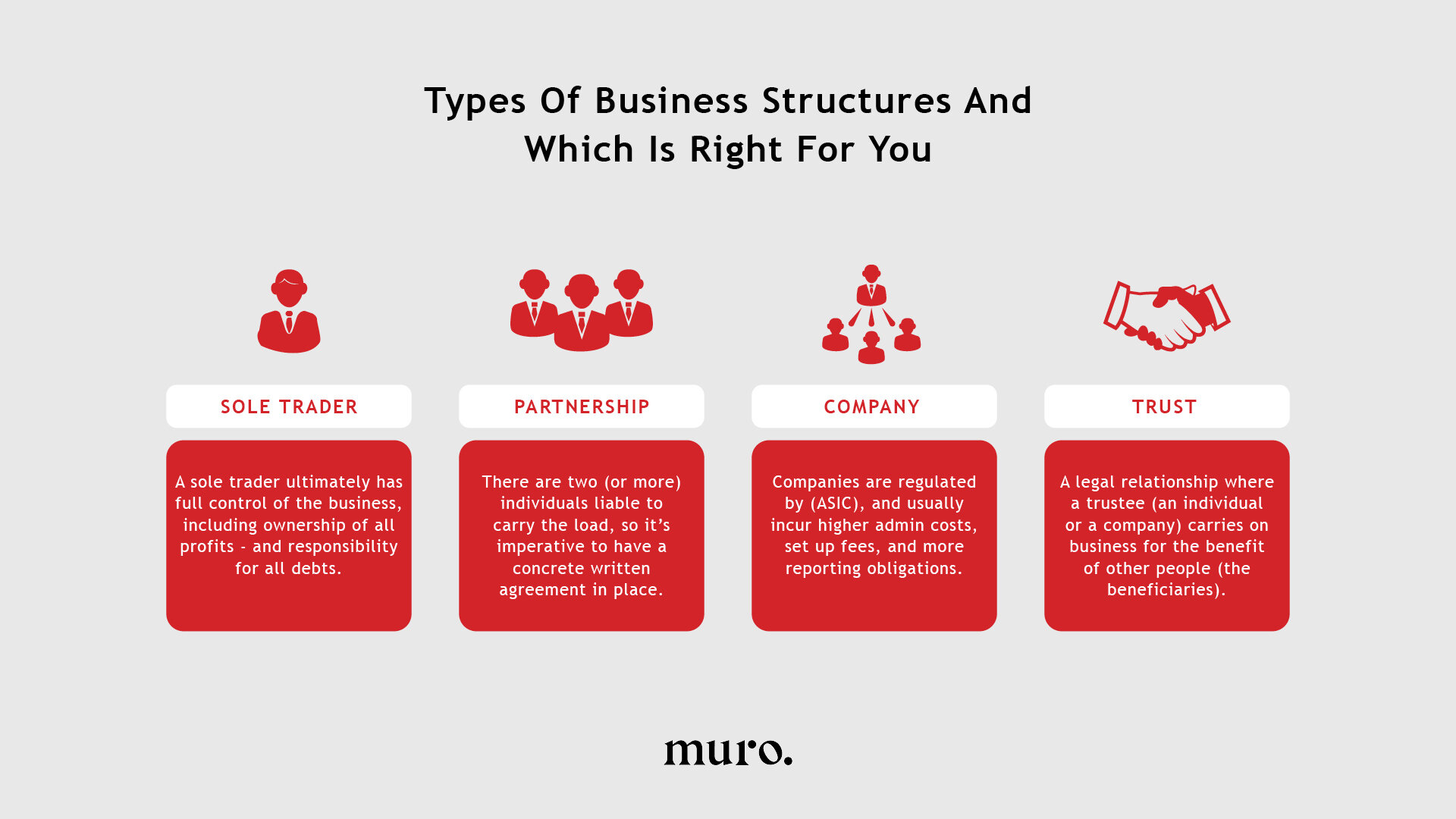

When setting up or restructuring an enterprise in Australia, there are usually four options to choose from when it comes to selecting a business structure that’s right for you. While each has notable benefits and disadvantages, it usually boils down to your individual circumstances and future intentions as to what is considered “best”.

Sole Trader - Often considered to be the easiest and most inexpensive business structure, a sole trader ultimately has full control of the business, including ownership of all profits - and responsibility for all debts. While you can employ workers in your business, you can’t employ yourself. As a sole trader, if your turnover is less than $75,000, you don’t need to pay GST (Goods And Services Tax).

Partnership - With the fundamentals being similar to a sole trader business structure, the major difference in a partnership set up is that there are two (or more) individuals liable to carry the load. A partnership requires an intention to make and share profits and an understanding that these co-owners act on behalf of each other in business, so it’s imperative to have a concrete written agreement in place. It is important to note that there are many different partnership structures.

Company - Companies are regulated by the Australian Securities & Investments Commission (ASIC), and usually incur higher administrative costs, set up fees, and more reporting obligations. While this business structure provides more asset protection, in some cases it’s directors can be legally liable for their actions and, in some cases, the debts of the company and its shareholders.

Single Discretionary Trust - A trust is a legal relationship where a trustee (an individual or a company) carries on business for the benefit of other people (the beneficiaries). Setting up a trust as a business structure can be expensive, as a formal deed is required to outline how the trust will operate. If all trust income is distributed to adult resident beneficiaries, the trust is not liable to pay tax - as each beneficiary reports the income in their own tax return.

When launching or restructuring a business, there are a few other key legal requirements that also require your attention. Some of the more generalised ones include -

Registering for an Australian Business Number (ABN)

Registering for PAYG Withholding

Payroll tax registration

Business name registration or changes

Trademark registration

ASIC registration for Australian companies

Applications for limited partnership formations

Registration for GST (Goods and Services Tax)

If you’re in the process of navigating the many forms of business structures available in Australia, it’s crucial not to forget the superannuation obligations of both your staff and yourself. With self managed super funds on the rise in Australia, there are many factors to consider when choosing a plan for the future, such as tax obligations, fees, and asset protection. However, opting for a self managed super fund should never be taken lightly, and you should always speak to an industry professional or appropriately qualified accountant to help you navigate the legalities involved with this.

Choosing The Right Business Structure

Whether you’re starting a business, purchasing an existing one, or even reevaluating where your current enterprise stands - all require some form of financial know-how if you hope to successfully navigate your legal obligations along with hitting your business goals.

However, if understanding the fine print that surrounds your business finances isn’t your strong point, then it may be reassuring to know that you’re not alone. In fact, many businesses (big and small) enlist the services of an accountant in order to free up their time while knowing that their financial obligations are already taken care of by the professionals.

Ultimately, the team at Muro believe that every business owner is an entrepreneur. If you would like to take a deeper look into your finances or source help from the professionals when it comes to choosing the right business structure for your new or existing brand, please get in touch with us at Muro today to ensure that you’re on the right path for success.